Solar Hot Water Heater Federal Tax Credit

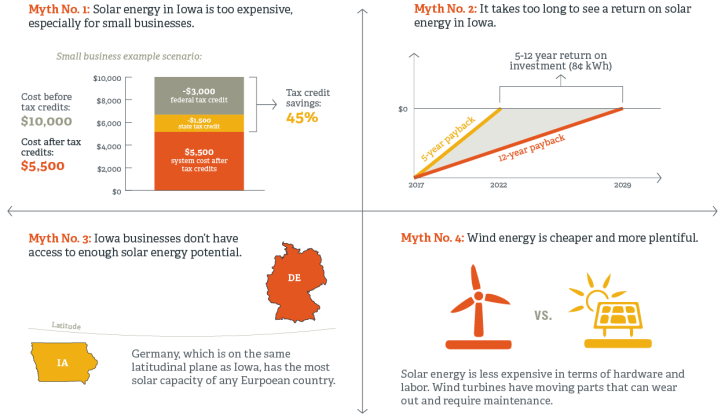

The state of hawaii offers a personal tax credit of 35 of the cost of the system or 2 250 whichever is less as well as a one time 750 rebate for existing homes not available for homes built after 2009.

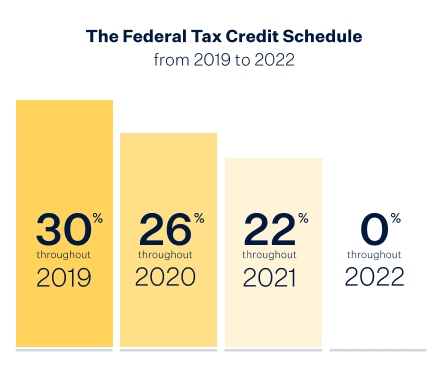

Solar hot water heater federal tax credit. Please note that qualifying property must meet the applicable standards in the law. Use irs form 5695 to claim this tax credit. Other common questions about solar hot water heater tax credits. The expiration date for solar technologies and wind is based on when construction begins.

File tax form 5695 with your tax return. Do solar hot water repairs qualify for tax credits. Teo solar the federal tax credit is 30 of your solar investment in solar panels and solar water heaters and this includes installation cost as well. Is a solar water heater installed for a swimming pool or hot tub eligible for a tax credit.

Uniform energy factor uef 0 82. Honolulu solar roofs initiative. The tax credit is for 300. The table below shows the value of the investment tax credit for each technology by year.

The residential energy property credit which expired at the end of december 2014 was extended for two years through december 2016 by the protecting americans from tax hikes act of 2015. Solar energy systems solar water heaters solar water heaters come in a wide variety of designs all including a collector and storage tank and all using the sun s thermal energy to heat water. The tax credit for builders of energy efficient homes and tax deductions for energy efficient commercial buildings have also been retroactively extended through december 31 2020. Uniform energy factor uef 2 2.

Residential gas oil propane water heater. Tax credits for residential energy efficiency have now been extended retroactively through december 31 2020. Before 2016 different types of water heaters were eligible for the energy efficiency tax credits. State solar hot water incentives.

Residential electric heat pump water heater. Federal income tax credits and other incentives for energy efficiency. The federal business energy investment tax credit itc has been amended a number of times most recently in december 2015. They are considered maintenance expenses rather than home improvement expenses and therefore are not eligible.

Residential water heaters or commercial water heaters and select yes for tax credit eligible under advanced search. Water heaters natural gas propane or oil biomass stoves. Local solar hot water incentives. However for the tax years 2017 through 2021 only qualifying solar systems are eligible for water heater tax credits on your federal tax returns.